Last month, the European Commission adopted a comprehensive package comprising of a few measures that will strengthen investments in sustainable activities across the European Union. The measures are meant to make investors shift to more sustainable technologies and businesses.

Basically, the package will further contribute to the EU’s goal to position itself as a global leader in applying standards for sustainable finance.

In fact, the EU Taxonomy Regulation, the Sustainable Finance Disclosure Regulation and the Benchmark Regulation that were enacted during the last few years laid out the foundation for a sustainable financial system that supports the transition towards a climate-neutral Europe.

Why an EU taxonomy?

In order to reach the objectives set in the European Green Deal, the European Union has committed to direct investments towards sustainable projects and business activities. Ultimately, the effects of such efforts will make our economies more resilient against environmental wrecks.

And to achieve such goals, the EU set a clear definition of what undertakings can be defined as ‘sustainable’. As a result, the “EU Taxonomy” was created as a common classification system for sustainable economic activities.

What is the EU taxonomy?

The EU taxonomy establishes a list of environmentally-friendly economic activities that are defined as sustainable. It is an important instrument to increase sustainable investment and to enforce the European Green Deal.

Providing clear and concise input on which economic activities are considered environmentally sustainable, the EU expects to create peace of mind for investors and protect private investors from greenwashing. Additionally, the Commission is currently developing an online tool that will facilitate the use of the taxonomy.

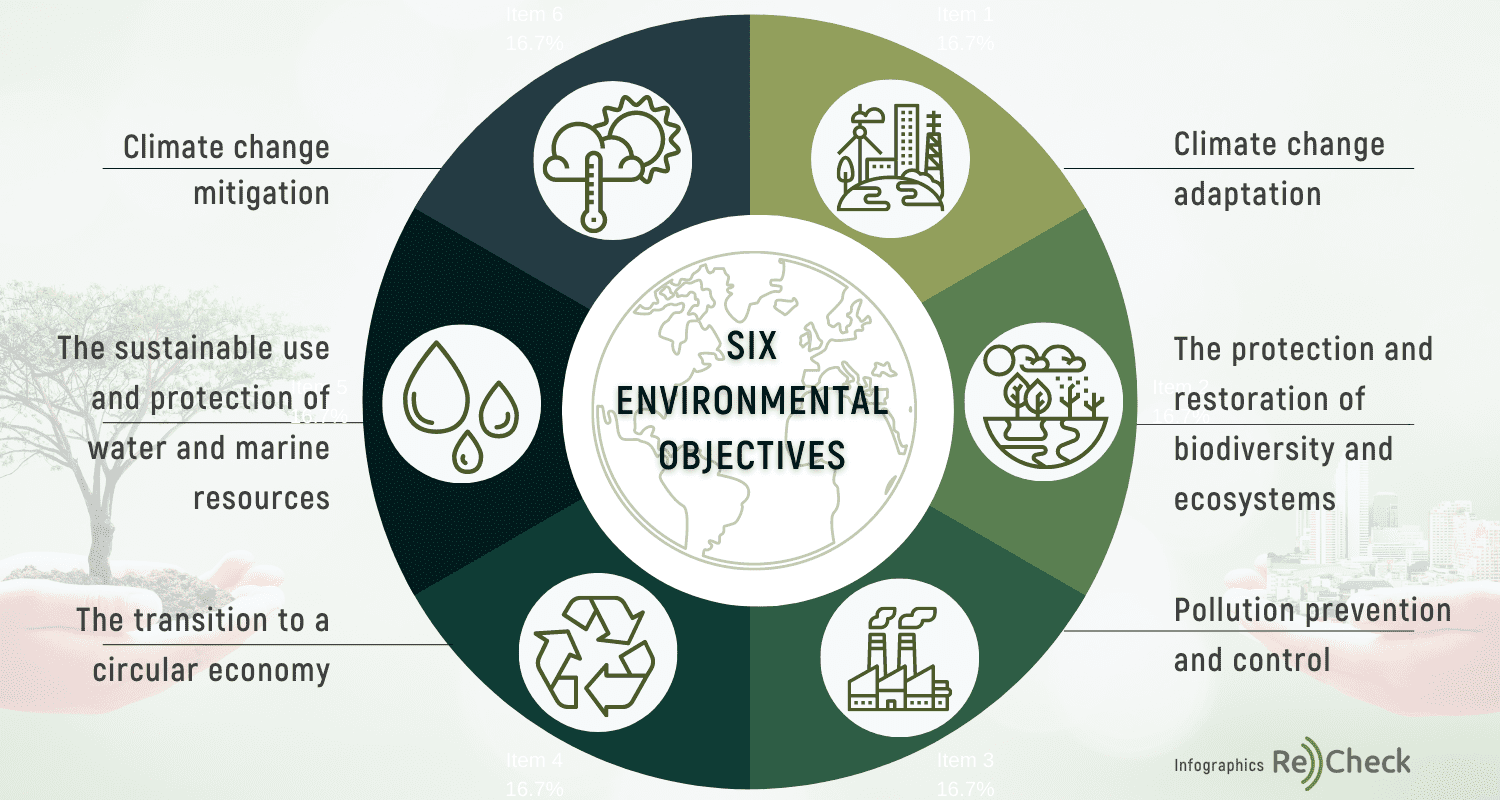

When the Taxonomy Regulation entered into force last year, it also established six environmental objectives:

- Climate change mitigation

- Climate change adaptation

- The sustainable use and protection of water and marine resources

- The transition to a circular economy

- Pollution prevention and control

- The protection and restoration of biodiversity and ecosystems

In order to define the technical screening criteria for each environmental objective, the European Commission is enforcing delegated acts.

Shifting towards sustainable finance

The comprehensive package that the European Commission adopted just last month consists of a few very particular measures in a way that it builds on and develops the framework set by the Taxonomy Regulation:

The EU Taxonomy Climate Delegated Act

The EU Taxonomy Climate Delegated Act is expected to formally be adopted by the end of this month. It introduces the first set of technical screening criteria that will define whether an economic activity contributes to two of the environmental goals under the Taxonomy Regulation – climate change adaptation and climate change mitigation.

The technical screening criteria in the Act was created based on advice from the Technical Expert Group (TEG) on sustainable finance. Initially, the Delegated Act is supposed to cover the economic activities of roughly 40% of listed companies operating in sectors responsible for almost 80% of the greenhouse gas emissions in Europe. It currently includes sectors such as energy, forestry, manufacturing, transport and buildings. However, criteria will be subject to regular review in order to ensure that new sectors and economic activities are accordingly added over time.

Corporate Sustainability Reporting Directive

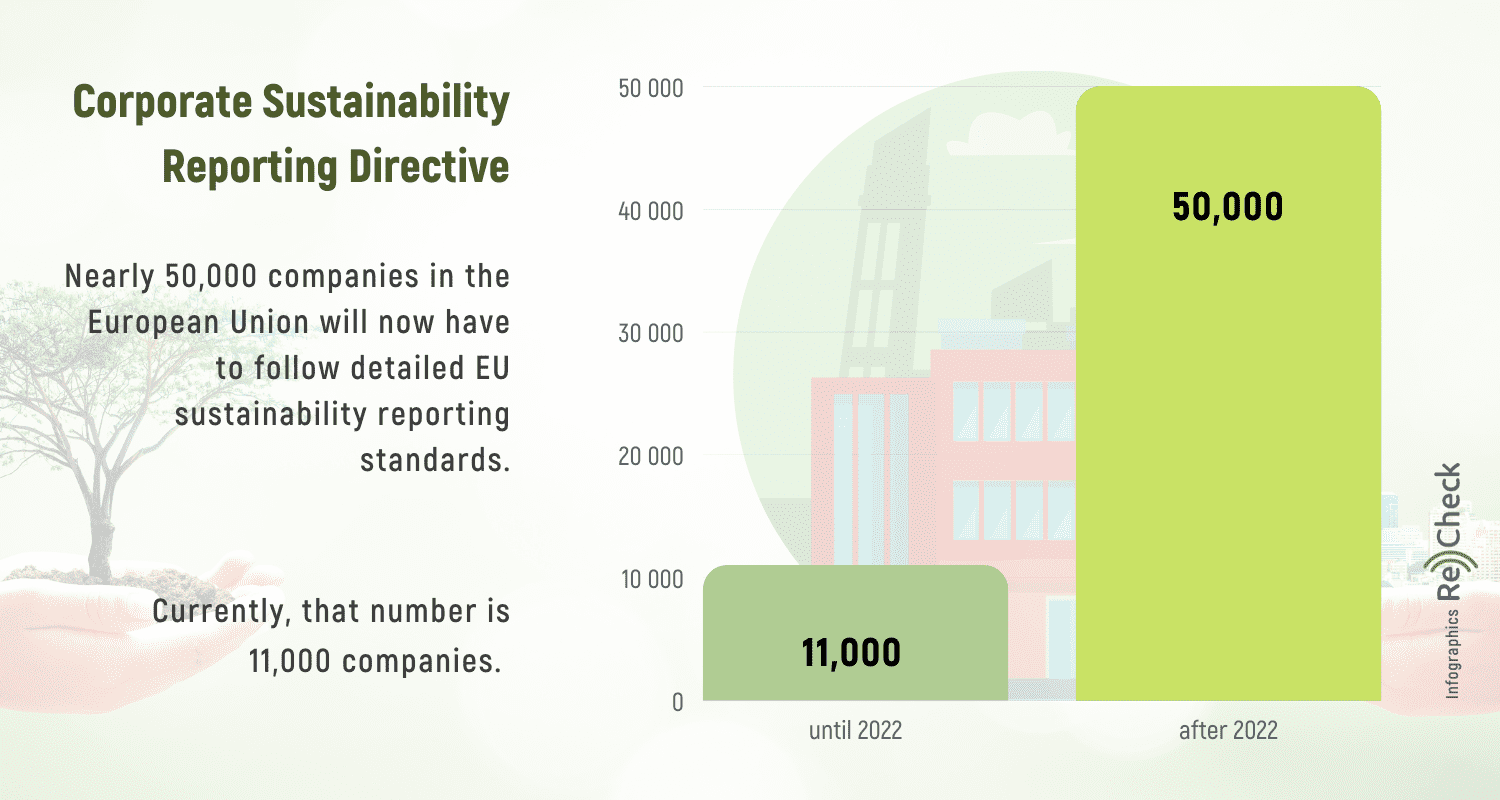

A proposal for a Corporate Sustainability Reporting Directive (CSRD) that will improve the flow of sustainability data. The Directive will make sustainability reporting more consistent so that investors can use comparable and trustworthy information on sustainability activities.

The Directive aims to create a set of rules that will level sustainability reporting to financial reporting. It will extend the EU’s sustainability reporting requirements to all large companies and all listed companies. Nearly 50,000 companies in the European Union will now have to follow detailed EU sustainability reporting standards. Currently, that number is 11,000 companies. The Commission is also planning to develop standards proportionate standards for SMEs, which non-listed SMEs can use voluntarily.

Amendments to Delegated Acts on investment and product governance

The six amendments that are part of the package will encourage the financial system to support sustainable businesses and also strengthen the EU’s efforts against greenwashing. The amendments define the responsibilities of financial companies when assessing their sustainability risks, such as the impact of floods on the value of investments. Furthermore, manufacturers of financial products and financial advisers will have to consider sustainability factors when designing their financial products.

In the next few years, the business landscape in Europe will have to adjust to the new political reality. Laws are disturbing complete ecosystems, pushing for more sustainable models and fighting against bogus greenwashing.

Let’s talk about how we can help you improve sustainability data and make better investment decisions!

Related: ESG Performance Metrics Are Wrecked – Now What?